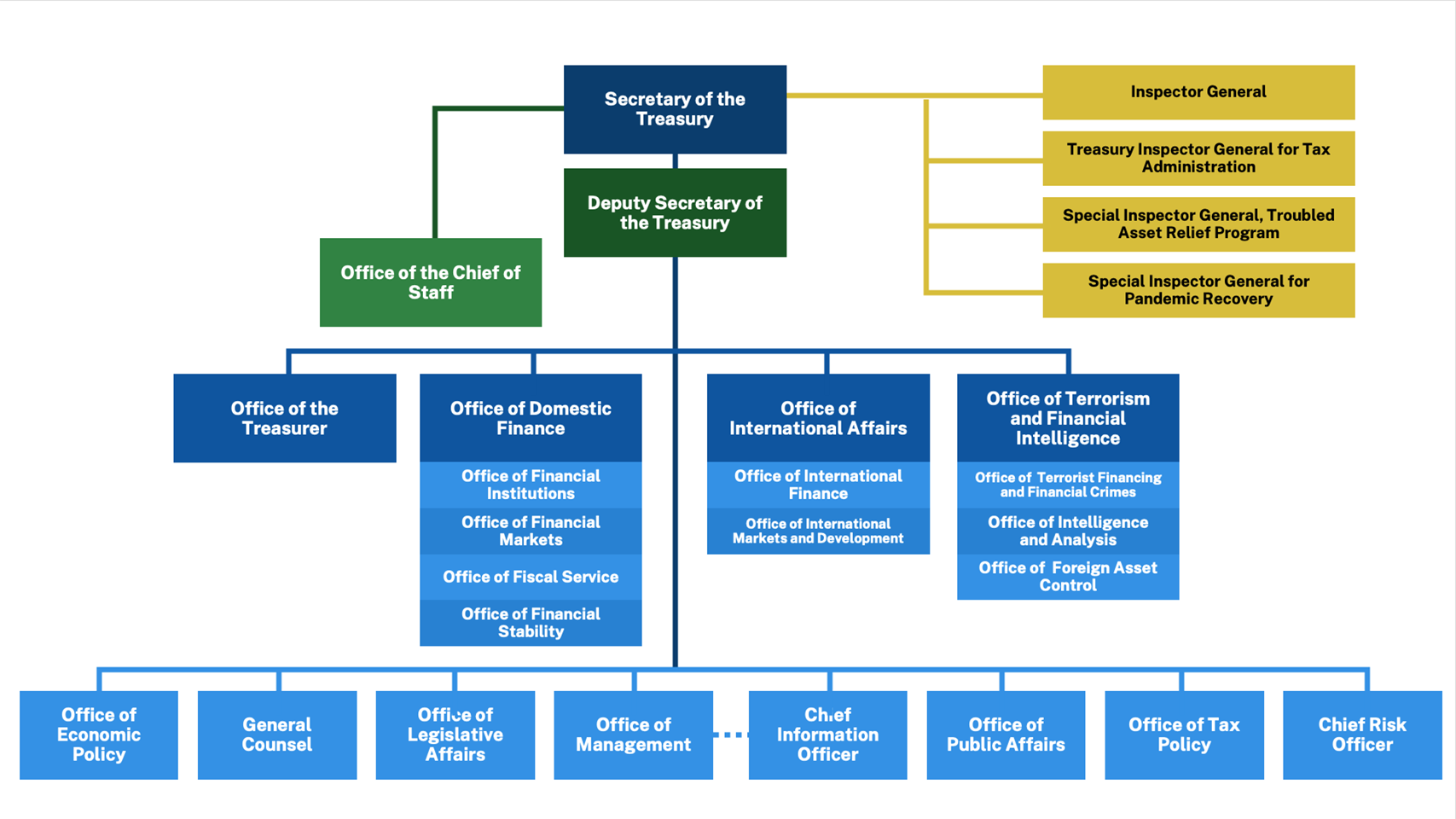

U.S. Department of the Treasury

The Treasury Department is the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States. The basic functions of the Department of the Treasury include:

The Treasury Department is the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States. The basic functions of the Department of the Treasury include:

- Managing Federal finances;

- Collecting taxes, duties and monies paid to and due to the U.S. and paying all bills of the U.S.;

- Currency and coinage;

- Managing Government accounts and the public debt;

- Supervising national banks and thrift institutions;

- Advising on domestic and international financial, monetary, economic, trade and tax policy;

- Enforcing Federal finance and tax laws;

- Investigating and prosecuting tax evaders, counterfeiters, and forgers.

Meet Secretary Yellen

On January 26, 2021, Janet Yellen was sworn in as the 78th Secretary of the Treasury of the United States. An economist by training, she took office after almost fifty years in academia and public service. She is the first person in American history to have led the White House Council of Economic Advisors, the Federal Reserve, and the Treasury Department.

CEA Highlights Industry Priorities for Secretary Yellen

February 26, 2021 - Two issues will be of preeminent importance not only to our members and their union workforce but also to the Biden Administration as it ramps up its efforts to rebuild the economy and the country’s infrastructure: misclassification of employees as independent contractors, which is rampant in the construction industry, and relief and reform of the multiemployer defined benefit pension system. Federal policies and regulations should be reformed to favor law abiding companies that are creating and sustaining pathways to the middle class.

- CEA employers urge Treasury and the Biden Administration to address important tax issues that create competitive advantages for businesses willing to game the system at the expense of their legally compliant competitors, the government, and taxpayers. Treasury must take steps to address the safe harbor provisions of Section 530 of the Internal Revenue Code that facilitate misclassification and work with Congress to empower the IRS to be more aggressive in the fight against misclassification.

- CEA also urges Treasury, as a member of the Pension Benefit Guaranty Corporation (PBGC) Board, to help stabilize construction industry multiemployer pension plans and to press Congress for Composite Plans as a long-term multiemployer pension funding remedy. Construction industry plans account for over half of all multiemployer defined benefit plans and cover nearly four million plan participants. The current system is fragile and in need modernization this year, not in the future.

Contact Us

SMACNA National Headquarters 4201 Lafayette Center Drive Chantilly, Virginia 20151 Tel: (703) 803-2980

Inquiry Form