SMACNA Joins Other Trade Associations in Supporting Bipartisan Tax Legislation

U.S. House Ways and Means Committee features SMACNA’s statement of support for the Tax Relief for American Families and Workers Act.

Due to the robust and record-setting growth of the construction, CHIPS, energy efficiency, and manufacturing industries in the last two years, SMACNA strongly supports renewing and extending the 100% bonus depreciation and 179 equipment expensing reform. With the rapid expansion of the mega projects following the bipartisan infrastructure law, CHIPS, and Science Act, and other IRA-related private sector tax incentives for energy-efficient retrofits, SMACNA contractors have seen a historical demand to purchase expensive but highly productive new equipment to meet project demands.

As part of this ongoing effort SMACNA joined over 250 other trade associations supporting the Bipartisan Tax Relief for American Families and Workers Act (H.R. 7024) with 100 percent immediate expensing for equipment and machinery, U.S. investment growing over 20 percent). This legislation maintains several key tax provisions, including extending research and development expensing, expanding interest deductibility, and ensuring 100 percent immediate expensing for equipment and machinery; U.S. investment grew over 20 percent.

SMACNA has shared with Congress and federal policy leaders for half a decade that our members have the strongest support for three essential tax incentive provisions:

- Retroactive Extension of the 100% Bonus Depreciation – This would restore the 100% bonus depreciation for qualified property instead of the current 20% annual phase-down that went into effect on January 1, 2023.

- Retroactive Extension and Permanence for 174 Research and Development Expenditures - This would allow companies to deduct R&D expenses immediately instead of amortizing over five years.

- Expand Section 179 expensing and interest deductibility for small businesses. This would increase the maximum eligible investment amount and extend the point at which the benefit phases out.

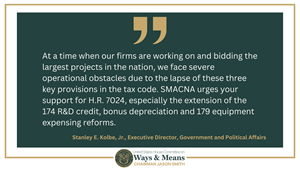

In his statement of support, shown below in a release from the House Ways and Means Committee, Stan Kolbe, SMACNA’s Executive Director of Government and Political Affairs, urged Members of Congress to pass HR 7024 so that several vital SMACNA-Supported provisions would be extended.

Jan 29, 2024 — Member Update

Latest Articles

Feb 25, 2026 - Document will assist members understand and navigate the current uncertain climate surrounding tariffs.

Feb 25, 2026 - Devon Madon and Ernie Menold are featured in our podcast series highlighting some of the younger voices in our association, their experiences and detailing their industry journey!

Feb 25, 2026 - Veteran sales management professional with two decades of experience will take the lead on several of SMACNA’s key initiatives, including our Premier Partners and Associate Member program.