The energy sector is ever evolving. And the industrial market is quickly increasing project opportunities for industrial contractors. In fact, industrial contractors will surely play a pivotal role in carbon capture and utilization. Carbon capture technology and the megaprojects are drawing record amounts of private capital into the energy and energy efficiency-related technology sector’s battle against carbon-driven climate impacts.

The energy sector is ever evolving. And the industrial market is quickly increasing project opportunities for industrial contractors. In fact, industrial contractors will surely play a pivotal role in carbon capture and utilization. Carbon capture technology and the megaprojects are drawing record amounts of private capital into the energy and energy efficiency-related technology sector’s battle against carbon-driven climate impacts.

SMACNA contractors have opportunities to continue to be at the forefront of helping to construct the engineering feats involved in capturing and repurposing CO2 emissions — from innovative technologies to large-scale CCU projects.

The Environmental Challenges and Market Outlook

Due to increasing environmental concerns and the rising demand for solutions, the global carbon capture and sequestration market was valued at $2.1 billion in 2022, according to Vantage Market Research.

Research projects the market to reach $7.49 billion by 2030 — a compound annual growth rate of 19.9% between 2023 and 2030. They attribute this growth to second-generation carbon capturing techniques.

Global capacity to trap emissions from power plants and heavy industry and bury the carbon dioxide deep underground is forecast to reach 400 million tons by 2030, provided that all currently announced plants are built. That marks a significantly more optimistic outlook than the International Energy Agency’s 2020 forecast of 350 million tons by 2030.

The Intergovernmental Panel on Climate Change recommends keeping the global average temperature increase well below 2 degrees Celcius , if not below 1.5 degrees Celcius, by 2100 to avoid the most threatening projected effects of climate change. This effort to prevent worst case estimates of climate damage requires achieving carbon neutrality shortly after 2050. In the U.S., industrial emissions represent 22% of greenhouse gas emissions, but industrial processes are particularly hard to decarbonize because the processes emit CO2 as a byproduct of chemical reactions, and these industries require high-grade heat input.

“You have an enormous opportunity to solve the problem in the industrial sector,” explains Brad Crabtree, assistant secretary for the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management. “We’re seeing growing recognition of the role carbon management needs to play if we are to meet our carbon emissions goals.”

“You have an enormous opportunity to solve the problem in the industrial sector,” explains Brad Crabtree, assistant secretary for the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management. “We’re seeing growing recognition of the role carbon management needs to play if we are to meet our carbon emissions goals.”

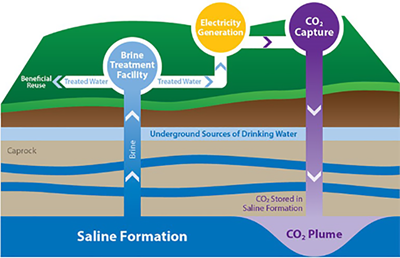

Infrastructure Bill Provides Funding for Carbon Management and Reduction Projects

To achieve net-zero emissions goals by mid-century, the U.S. will need to capture, transport and permanently store hundreds of millions of tons of carbon dioxide each year. This preventive strategy will also require a concerted effort to build out the infrastructure to store large quantities of carbon dioxide in geologic storage facilities.

The U.S. Department of Energy recently announced over $444 million to support 16 selected projects across 12 states that will fight climate change by bolstering the nation’s carbon management industry.

The projects, funded by the Biden Administration’s Bipartisan Infrastructure Law, will expand CO2 storage infrastructure needed to reduce CO2 emissions significantly and responsibly from industrial operations and power plants, as well as from legacy emissions in the atmosphere.

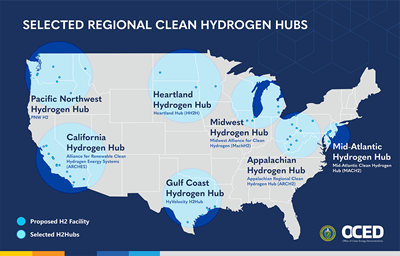

This includes up to $7 billion for regional clean hydrogen hubs and $2.5 billion for carbon capture demonstration. In addition, there are hundreds of billions of dollars in tax credits available for decarbonization projects, many already being utilized by private corporations and in public — private partnership megaprojects.

Opportunities to Advance Industrial Decarbonization

There are multiple areas for SMACNA’s industrial contractors to embrace these prospects.

First there’s hydrogen. Today, most hydrogen is produced using fossil fuels with high emissions, but policy is driving technological solutions toward the use of cleaner production sources. And “with IRA subsidies, hydrogen prices are expected to be much more competitive relative to natural gas prices,” says David Gardiner with David Gardiner and Associates, a strategic advisory firm with a mission to accelerate clean energy solutions and advance policy toward achieving transformational decarbonization.

The next large-scale, responsible deployment of carbon management technologies is crucial to meeting the administration’s ambitious climate goal of achieving a net-zero emissions economy by 2050. More than 100 carbon capture projects were announced in 2021, and there is the potential for many more — all capable of boosting the effort to curb emissions.

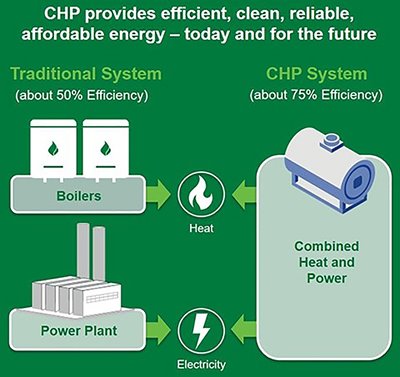

Transitioning combined heat and power (CHP) systems to produce zero carbon fuels is also an option. While CHP systems have efficiency rates as high as 90%, zero carbon fuels maintain CHP’s efficiency advantage. By 2030, new CHP systems are projected to burn 100% clean hydrogen. Existing CHP systems can convert to 100% clean hydrogen with minimal downtime. Paired with clean hydrogen, CHP achieves bold emissions reductions over time.

According to Gardiner, CHP projects qualify for 30% to 50% advanced energy Investment Tax Credits, which the IRA extends through 2024. The “Safe Harbor” provision extends the IRA tax incentives further into 2028 for projects that begin physical work of a significant nature or incur 5% of the total project costs. “Beginning in 2025, technology neutral ITC and PTC take effect,” Gardiner says. “CHP projects should qualify if they yield zero greenhouse gas emissions.”

According to Gardiner, CHP projects qualify for 30% to 50% advanced energy Investment Tax Credits, which the IRA extends through 2024. The “Safe Harbor” provision extends the IRA tax incentives further into 2028 for projects that begin physical work of a significant nature or incur 5% of the total project costs. “Beginning in 2025, technology neutral ITC and PTC take effect,” Gardiner says. “CHP projects should qualify if they yield zero greenhouse gas emissions.”

The federal production tax credit (PTC) is available for each project stage, including PTC credits for the production of solar energy used to produce green hydrogen, the prodution of green hydrogen and a CHP tax credit for efficient combustion.